You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Airline News

- Thread starter YesterAirlines

- Start date

Your pics are always beautiful. I remember the pleasure of looking at the spotter photos of masters like you, Michael (Conventi) from Dusseldorf, sba757 from Miami and few other.

Your pics are always beautiful. I remember the pleasure of looking at the spotter photos of masters like you, Michael (Conventi) from Dusseldorf, sba757 from Miami and few other.

Thank you

PeachStateAviation

Active member

I remember seeing somewhere that they regret not getting more 753s as they’re such a great aircraft. Despite the reassurance that the 75s will stay, the more special ones without winglets (both charter and normal configs) are still being phased out which I don’t see to much anymore here in ATL.Good news for the B757-200 and B757-300, for Delta Air Lines and for all USA spotters and enthusiasts: a recent interview with Delta CEO discovered airline B757 future.

"Delta plans to keep its Boeing 757s operational well beyond 2030, potentially into the late 2030s. Despite their advanced age (average age of about 27 years for 757-200s), these paid-off aircraft are economical to operate and essential for high-density routes, gradually being replaced only by Airbus A321neos.

Key points about the Delta B757 fleet:

Extended service life: The Boeing 757s are expected to fly for Delta until the late 2030s, said the company's fleet manager.

Economics: As fully paid-off and depreciated aircraft, operating costs are low despite maintenance expenses and fuel consumption.

Phased Replacement: The Airbus A321neo is replacing part of the fleet, but delivery delays (including the 737 MAX 10) are further pushing the 757 phaseout.

Use: The 757-300s are particularly popular for their high capacity (234 seats) on busy routes.

Fleet Size: Delta operates 88 Boeing 757-200s and 16 Boeing 757-300s".

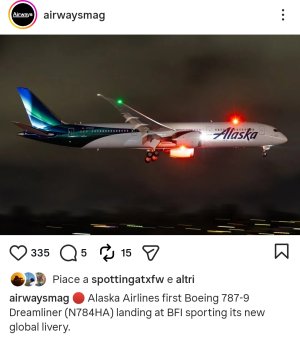

...and Alaska Airlines continues to buy airplanes.airwaysmag never disappoints.

Alaska Airlines B787-9 with new livery, really impressive!

View attachment 66068

BubblesAviation

Well-known member

Looks amazing!! Not crappy light in my opinion… as a DCA spotter I never get any widebodies so any widebody looks quite amazing to me

planes_on_a_shelf

Well-known member

C-3PO livery last flight currently being livestreamed

boeing737sjcboy

Active member

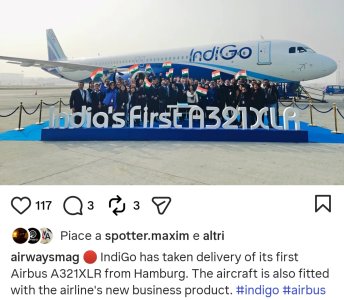

View attachment 66502

Looks like Allegiant is acquiring Sun Country. 2026 will be a year of mergers here in the US

Oh no...

BubblesAviation

Well-known member

Will the Tulsa-Cancun route and other Sun Country routes still be on @CM Aviation?

planes_on_a_shelf

Well-known member

Yay such airline diversityView attachment 66502

Looks like Allegiant is acquiring Sun Country. 2026 will be a year of mergers here in the US

Boeing_3019

Well-known member

Will the Sun Country brand be absorbed and all of their planes get repainted?View attachment 66502

Looks like Allegiant is acquiring Sun Country. 2026 will be a year of mergers here in the US

Interesting thread about Allegiant and Sun Country merge.

skift.com

skift.com

The U.S. low-cost airline sector has been getting crushed, but the surprise merger between Allegiant Air and Sun Country Airlines is not driven by weakness or desperation.

It’s the opposite: They are two of the most disciplined, profitable, and strategically coherent airlines in the segment.

Both carriers have consistently outperformed low-cost peers on profitability, even as cost inflation, labor pressure, and competition from network carriers intensified.

A chart of operating margins for the past six quarters tells the story: While peers like Spirit Airlines and Frontier Airlines slipped deeper into losses, Allegiant and Sun Country remained profitable through most of the cycle — at times delivering margins that rivaled, and occasionally exceeded, those of Delta and United.

This exclusivity protects yields, reduces fare wars, and allows Allegiant to operate profitably with less-than-daily and highly seasonal service — an operating muscle few carriers possess.

Sun Country has also been successful but more through diversification. In Q3 2025, more than 60% of Sun Country’s revenue came from cargo, charter, and ancillary streams. Scheduled passenger service accounted for just over a third of revenue.

Its cargo flying for Amazon, combined with charter operations and a disciplined seasonal capacity strategy, has fundamentally de-risked the business.

Other carriers have attempted to outfly the reality — adding capacity, chasing share, and hoping costs would normalize. Allegiant and Sun Country did the opposite. They adapted their models early, preserved balance sheet strength, and accepted that being highly focused is more valuable than being broadly relevant.

Together, Allegiant and Sun Country bring complementary strengths: Exclusive leisure networks, deep expertise in seasonal flying, diversified revenue streams, and management teams with a track record of discipline.

Importantly, this combination does not aim to be everything to everyone. It creates a platform that can flex with demand, absorb shocks, and selectively grow as the industry evolves.

In a value carrier sector defined lately by denial and drift, this merger stands out as something more rare: a strategic decision rooted in self-awareness. Big is not necessarily better — clarity, discipline, and realism usually

The Anti-Spirit Merger: Why Allegiant-Sun Country Makes Sense

The surprise merger between Allegiant Air and Sun Country Airlines is not driven by weakness or desperation.

skift.com

skift.com

The U.S. low-cost airline sector has been getting crushed, but the surprise merger between Allegiant Air and Sun Country Airlines is not driven by weakness or desperation.

It’s the opposite: They are two of the most disciplined, profitable, and strategically coherent airlines in the segment.

Both carriers have consistently outperformed low-cost peers on profitability, even as cost inflation, labor pressure, and competition from network carriers intensified.

A chart of operating margins for the past six quarters tells the story: While peers like Spirit Airlines and Frontier Airlines slipped deeper into losses, Allegiant and Sun Country remained profitable through most of the cycle — at times delivering margins that rivaled, and occasionally exceeded, those of Delta and United.

Two Different Models, One Shared Philosophy

Allegiant’s model is built on network exclusivity and ultra-focused leisure demand. Roughly 89% of Allegiant’s routes in Q3 2025 were unique, a figure unmatched in the U.S. market and extremely difficult to copy today given slot constraints, airport congestion, and constant pressure from rival airlines.This exclusivity protects yields, reduces fare wars, and allows Allegiant to operate profitably with less-than-daily and highly seasonal service — an operating muscle few carriers possess.

Sun Country has also been successful but more through diversification. In Q3 2025, more than 60% of Sun Country’s revenue came from cargo, charter, and ancillary streams. Scheduled passenger service accounted for just over a third of revenue.

Its cargo flying for Amazon, combined with charter operations and a disciplined seasonal capacity strategy, has fundamentally de-risked the business.

Why This Merger Makes Sense Now

Both airlines recognized the same structural truth that others ignored: The traditional playbook for ultra low-cost carriers no longer works. Flying every day, everywhere, with a single revenue lever is too fragile.Other carriers have attempted to outfly the reality — adding capacity, chasing share, and hoping costs would normalize. Allegiant and Sun Country did the opposite. They adapted their models early, preserved balance sheet strength, and accepted that being highly focused is more valuable than being broadly relevant.

Together, Allegiant and Sun Country bring complementary strengths: Exclusive leisure networks, deep expertise in seasonal flying, diversified revenue streams, and management teams with a track record of discipline.

Importantly, this combination does not aim to be everything to everyone. It creates a platform that can flex with demand, absorb shocks, and selectively grow as the industry evolves.

In a value carrier sector defined lately by denial and drift, this merger stands out as something more rare: a strategic decision rooted in self-awareness. Big is not necessarily better — clarity, discipline, and realism usually

planes_on_a_shelf

Well-known member

This works really well!

Similar threads

- Replies

- 9

- Views

- 413

- Replies

- 3

- Views

- 399

- Replies

- 87

- Views

- 3K